Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. For more details, see our Form CRS, Form ADV Part 2 and other disclosures. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. Carbon Collective's internet-based advisory services are designed to assist clients in achieving discrete financial goals. Before investing, consider your investment objectives and Carbon Collective's charges and expenses. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Investments in securities: Not FDIC Insured All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Carbon Collective does not make any representations or warranties as to the accuracy, timeless, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Carbon Collective's web site or incorporated herein, and takes no responsibility therefor.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Please refer to our Customer Relationship Statement and Form ADV Wrap program disclosure available at the SEC's investment adviser public information website: CARBON COLLECTIVE INVESTING, LCC - Investment Adviser Firm (sec.gov). By comparing the inventory turnover ratios of similar companies in the same industry, we would conclude whether the inventory ratio of Cool Gang Inc.

#Inventory turnover ratio registration#

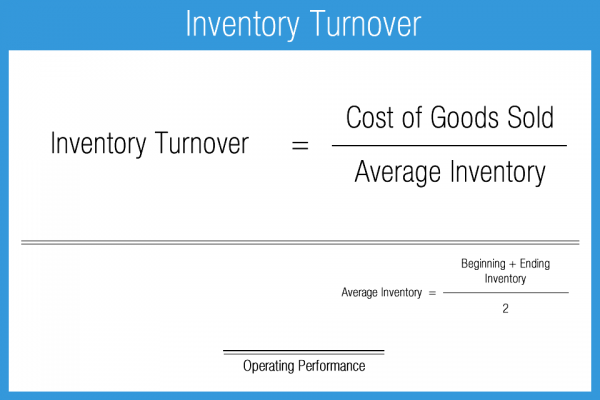

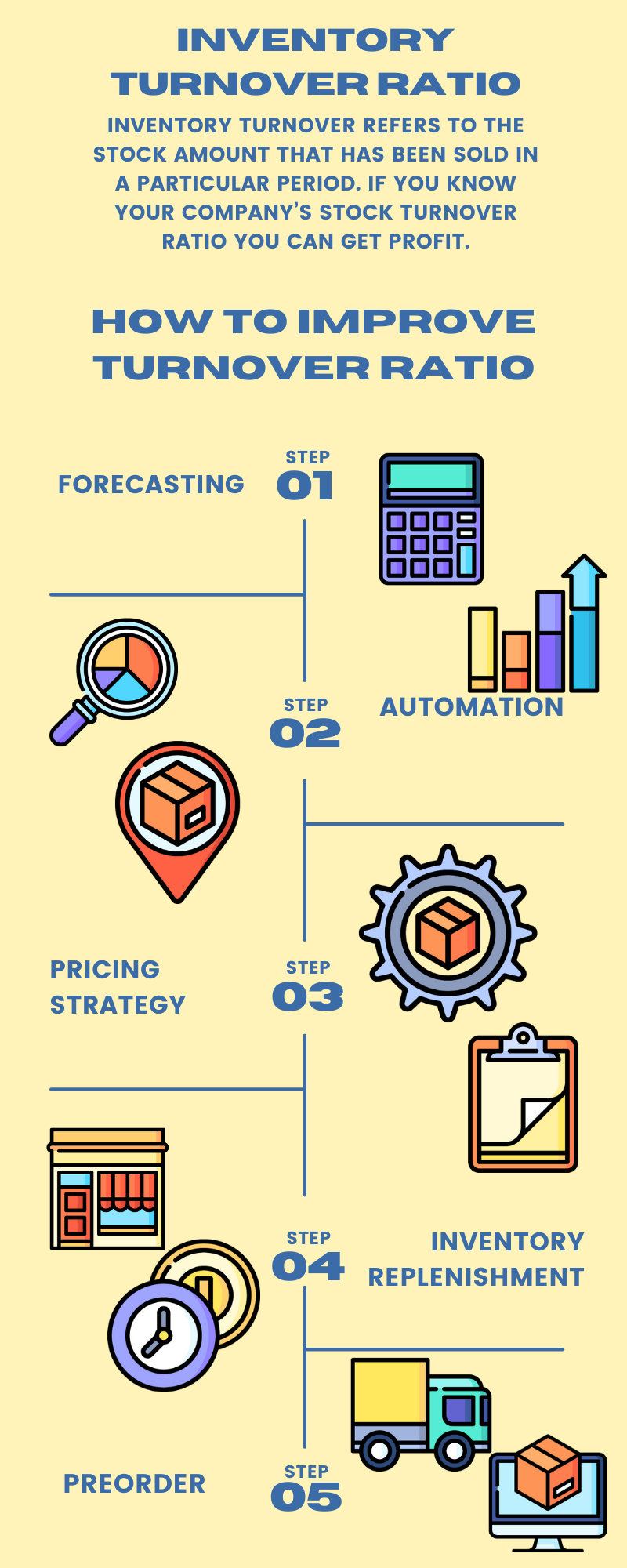

Registration with the SEC does not imply a certain level of skill or training. Inventory ratio Cost of Goods Sold / Average Inventories. The longer an item is held, the higher its holding cost will be, and so companies that move inventory relatively quickly tend to be the best performers in an industry.Ĭontent sponsored by Carbon Collective Investing, LCC, a registered investment adviser. The speed at which a company is able to sell its inventory is a crucial measurement of business performance. Define Inventory Turnover Rate in Simple Terms Investors may also like to know the inventory turnover rate to determine how efficiently one company is performing against the industry average. While strong sales are good for business, insufficient inventory is not. A high ratio can imply strong sales, but also insufficient inventory. This could be due to a problem with the goods being sold, insufficient marketing, or overproduction. The purpose of calculating the inventory turnover rate is to help companies make informed decisions about pricing, manufacturing, marketing, and purchasing new inventory.Ī low ratio can imply weak sales and/or possible excess inventory, also called overstocking. The formula for calculating the inventory turnover rate is as follows:įor example, a company with $20,000 in average inventory with a COGS of $200,000 will have an ITR of 10. It also opens the company up to trouble if the prices begin to fall.Ī good rule of thumb is that if inventory turnover ratio multiply by gross profit margin (in percentage) is 100 percent or higher, then the average inventory is not too high.Inventory turnover rate (ITR) is a ratio measuring how quickly a company sells and replaces inventory during a given period. High inventory levels are usual unhealthy because they represent an investment with a rate of return of zero. A low turnover rate can indicate poor liquidity, possible overstocking, and obsolescence, but it may also reflect a planned inventory buildup in the case of material shortages or in anticipation of rapidly rising prices.Ī high inventory turnover ratio implies either strong sales or ineffective buying (the company buys too often in small quantities, therefore the buying price is higher).A high inventory turnover ratio can indicate better liquidity, but it can also indicate a shortage or inadequate inventory levels, which may lead to a loss in business. It also implies either poor sales or excess inventory. This ratio should be compared against industry averages.Ī low inventory turnover ratio is a signal of inefficiency, since inventory usually has a rate of return of zero.

Average inventory should be used for inventory level to minimize the effect of seasonality. Inventory Turnover Ratio is figured as "turnover times". Its purpose is to measure the liquidity of the inventory. Inventory Turnover Ratio measures company's efficiency in turning its inventory into sales. Inventory Turnover Ratio is one of the efficiency ratios and measures the number of times, on average, the inventory is sold and replaced during the fiscal year.

0 kommentar(er)

0 kommentar(er)